16 Tips from the Dave Ramsey Plan That You Need to Know

This article may contain affiliate links. I may earn money from the companies mentioned in this post with no additional cost to you. Please read my disclosure policy for more info. All Bible quotations are from the New King James Version (NKJV) unless otherwise stated Bible Copyright Attribution.

If you’ve been researching debt freedom tips and personal finance, I’m sure you’ve come across the Dave Ramsey plan.

His most popular plan is his Dave Ramsey Baby Steps. He definitely has some experience in financial crisis and he is a living testimony of God’s goodness.

If you’re just starting out on your financial journey, you are on the right track. Looking for financial advice and money management tips is a great place to start.

Who is Dave Ramsey?

Dave Ramsey is a popular expert on finance. Dave Ramsey’s goal is to help others gain financial freedom. So where does this financial freedom principle come from?

The Bible. If you study the Bible then you will know that we are warned multiple times in the Bible about debt and that we shouldn’t become slaves to it.

So basically, Dave Ramsey is sharing what the Bible says about money. He has financial advice on most topics and has written books like the Total Money Makeover.

He also answers financial questions in his podcast. But be careful, he’s not very Christ-like when it comes to your financial failures. I was actually surprised by the way he was speaking to people looking for help. Make sure you can handle tough criticism.

What are Dave Ramsey’s Baby Steps?

Dave Ramsey’s financial advice to “Get Out of Debt” is to use his Dave Ramsey 7 Baby Steps. He made it really easy by breaking down the normal debt-free and financial freedom tips into little steps.

It actually helps those of us who like to work on smaller tasks. Personally, big tasks are hard for me to accomplish. Working in steps helps me stay motivated. Becoming debt-free and gaining financial freedom is a great goal to accomplish.

Dave Ramsey Baby Steps

Step 1. Save $1,000 for an emergency fund. This is a great first step. You’re trying to get out of debt so doing this helps you have a little bit of money put away for those unexpected situations.

Step 2. Pay off all your debts (except your mortgage). This means you need to put every extra penny you have toward paying off your debt. You can pick any method you’d like to do. Dave Ramsey recommends the debt snowball method.

This is one of the hardest steps in my opinion. We were in $35,000 of credit card debt and took every penny we had to pay it off. The debt snowball method has you focusing on paying the smallest amount first.

We decided that we wanted to pay off the highest interest-rate items first. That method is referred to now as the Debt Avalanche Method.

Step 3. Save 3-6 months of expenses in savings. Now that you got your debt paid off, you need to prepare for a life crisis that may consist of a job loss or medical event. This will allow you to pay your bills while you’re going through that tough time.

If you have a job with plenty of sick time, that should cover this step. For example, my husband has a year of sick time saved up. We live on one income so his job is the only income we have. If something happens to him, he can use his sick time. If he lost his job, they would pay him his sick time. We also have large life insurance policies.

Step 4. Invest 15% of your income in retirement. This is another important step. You’re debt-free and now you should be looking at your future. Do not rely on social security, it is not enough to live. You need to be saving for your own retirement.

Make sure to check if your employer does an employer contribution for retirement. My husband’s work contributes around 8% so that’s half of what’s recommended here. It’s basically free money towards your retirement.

Step 5. Save for your children’s college fund. If you are planning to send your children to college, this would be very helpful to them.

Step 6. Pay off your home early. This can be done in a few different ways. You can pay extra every month toward your monthly payment or refinance into a shorter loan period. We have the goal of paying off our mortgage by the time my husband retires, so we decided to refinance into a shorter fixed mortgage to line ourselves up properly.

Step 7. Build wealth and give. This is a great step. Giving to charities, saving for your family, and just living generously is a blessings. We didn’t wait for this step. We never stopped tithing at step 1. We had faith from the beginning that the Lord would provide for us and He did.

The Dave Ramsey Plan and Tips

The Dave Ramsey Baby Steps above cover the foundation of becoming debt-free. As I mentioned above, he wants to encourage everyone to have financial freedom. The Dave Ramsey plan and tips below are things we implemented into our own life. There are lots of ways to save money and Dave Ramsey has some good ones.

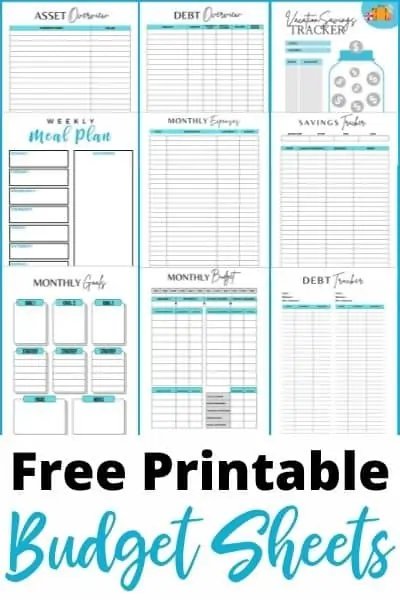

1. Create a Zero-Based Budget using the Envelope System

You’ve probably heard of this one. In fact, Dave Ramsey didn’t come up with the idea but it’s still a good one. The idea is that if you use cash, you can set aside the cash for each budget category you create in your monthly budget.

This is referred to as the cash envelope method. You designate an envelope for each personal budget category and only use the cash in the envelope for that specific category.

This is where the zero budget comes in. Since every penny of your income would be assigned to an envelope you would have zero dollars left outside of the envelopes. You’re less likely to spend out of your budget when you have the money assigned.

We basically do this but we don’t use cash. I have our money budgeted in a budgeting app and we do a great job sticking to it. We learned how to create a budget and never looked back. We started off using a free budget template before we moved to the budgeting app. All of it takes discipline. It’s whatever works for you.

2. Keep your Current Cell Phone

People have probably called Dave Ramsey for tips on their cell phones. If they did, I’m glad I missed it. I’m sure they would have gotten a Dave Ramsey scolding.

This is really a no-brainer. If your phone works keep it. Phones are so expensive now and are pretty much worth nothing. The marketing on phones is crazy, they essentially make you think you are missing out by not having the latest and greatest phone.

Why would you pay $1,000 or more every two years for a new phone that has a few more features than yours? If your phone is broken, there are plenty of refurbished and used phones for sale.

3. Pay Off Your Credit Card Balances Every Month

If you can’t pay off your credit cards every month, then don’t have them. Dave Ramsey recommends that you cut them up and don’t use them. Sure, there are rewards for using credit cards but are those rewards worth the amount of interest you’ll be charged by not paying them off?

We got ourselves out of debt 10 years ago. It’s been a lot of years but we’ve learned how to discipline ourselves with a credit card. We use it for everything possible and then pay it off every month.

Since I have my budget app, I can see the categories of everything I have budgeted to spend. This makes it easy to keep the credit card budget.

4. Try to Always Pay Cash

This is another good one but you have to use your own wisdom here. You should pay cash if the item you are paying for can potentially accrue interest. One example would be a credit card with “0 interest for 15 months”. This is just a scheme to get you into debt. Don’t do it.

Here’s an example of something we didn’t pay cash for or accrue interest. We got all three of our kid’s braces at the same time (ouch!). My husband’s dental insurance paid half but we still had to pay over $3,000 out of our pocket.

We were prepared to pay cash for it but it would have made our savings too low. Instead, the dentist offered us a payment plan with no interest.

We were able to make monthly payments with no interest. This allowed us to keep a cushion in our savings in case we needed it. Kids continue to grow and sometimes time is of the essence.

5. Have an Emergency Fund

This was discussed in Dave Ramsey’s Baby Steps above but I wanted to bring it up again. If you don’t have $1,000 in your emergency fund, where are you going to get the money for little incidents?

You’ll be putting it on a credit card and accruing high interest. Face it, things happen in life and it’s important that you are serious about having liquid money available.

6. Stop Buying New Cars

You may want to keep up with the Joneses but it’s not worth it. New cars depreciate in value the moment they are driven off the lot. I’ve had the same car for the last 10 years. It’s pretty beaten up but I’m sticking with it until it dies. Even if I need a new engine, that would be cheaper than buying a new car.

I’ve heard Dave Ramsey say multiple times “get rid of the car and buy a cheap one with cash”. Not having a car payment is an amazing feeling and I’d like to keep it that way as long as I can. If you must buy a car, consider getting it used to avoid immediate depreciation.

7. Learn to Live on Less

It’s hard to live on less because we think we need so many things to survive. I had to learn to live on less because we decided to live on one income. Honestly, I’m totally fine without all the things I thought I needed.

I’ve learned to save money on everything and that has helped me feel like I get more for less. I learned how to use coupons, got rid of cable, started buying used clothes online, and learned more ways to save money on groceries.

8. Earn Extra Income

Being a stay-at-home mom makes earning extra income a challenge. On top of being at home, I homeschool my kids so my time is very limited. There are some legitimate ways to make money for stay-at-home moms these days, I just don’t have the time.

If you do have the time to make a little extra income, check out this list of earning extra income ideas. I interviewed real people who make extra money from the comfort of their homes.

9. Participate in Free Activities

This goes right along with Dave Ramsey’s tips. You can definitely spend less if you’re in tune to free activities. We even participated in eating at kids eat free restaurants. My girls (they’re 14yrs old) are too old now but my son is still 10 yrs old so he can still get free kid’s meals.

Another fun thing to do is sign up for restaurant freebies. There are tons of restaurants that give you free food and/or desserts for your birthday. All you need to do is sign up and they’ll send you a birthday freebie. Check out this huge list of birthday freebies from restaurants I put together.

10. Stop Buying Name Brands

I’m a huge believer that when I buy a name brand, I’m buying the name. There are so many items that are exactly the same. Let’s take food for example. You can look at the ingredients of the name brand and the generic brand and they are exactly the same.

There are a few items that I’m willing to pay for the name brand because I do see a difference. Other than that, I buy generic.

11. Save on Utilities

We live in a mountain community where the outside temperature averages between 20 degrees and 40 degrees in the winter and up to 90 degrees in the summer. You can save lots of money on your gas and electric bill if you manage the heater and air conditioning.

Most people want to be comfortable. That’s fine if you’re willing to pay for it. We keep our heater at 60 degrees (in the day) and 63 degrees (at night) during the winter.

12. Eat at Home

We’ve made a commitment to eat at home 7 days a week. Dave Ramsey says to save where you can. This is one budget item that we decided to cut back on.

I create a meal plan every week and we stick to eating that each week. I usually try to make enough so we have leftovers for lunch during the week. There are lots of cheap meals that are actually good.

There are times that we go out to eat but it’s not as often as it used to be. We can easily spend over $100 with the five of us eating at a restaurant.

13. Stop Paying for an Unused Gym Membership

If you aren’t using the gym then you should stop paying for it. I believe fitness should be a part of everyone’s life. I attended the gym for 2 years before I made the decision to work out at home.

Working out at home has not only been a money saver but it’s also a time saver. I spent an extra 45 minutes a day just getting to and from the gym.

I’ve been working out successfully at home for over a year now. There are some really great workout programs you can do at home. I personally love the Beachbody On Demand workout program.

14. Do your Own Yardwork

Dave Ramsey says to find ways to cut back and this is one that we chose to cut back on. I love having a nice yard. Two years ago we decided to clean up our front yard and landscape it. We got a few quotes that were over $5,000 so my husband and I decided to do it ourselves. It took us about a week to complete but we only spent $2,000.

To this day we handle all our own yard work. I admit that I’m a little jealous of my neighbors when their gardeners arrive. It’s very tempting to hire someone. At the end of the day, I’m more excited about the money we’re able to save doing it ourselves.

15. Lessen your Wardrobe

Having less could mean having fewer clothes. I don’t have tons of clothes but I have what I need. I don’t like to buy clothes often so this one was easy for me. I mix and match all my clothes so I don’t need a lot. It also relieves me of stressing about what I’m going to wear.

16. Keep Saving

I don’t know about you but my mind is in a constant mode of saving money. Dave Ramsey mentions many specific ways to save but I’m going to keep this non-specific. I don’t classify myself as “cheap”. I like to find deals on things we are doing before we do them.

One of my favorite ways to save locally is with our local discount card. We live in a very small town so I can imagine that they are doing this in many different cities. We get 10% off of a ton of local businesses with the local discount card and it only costs me $10 a year.

The $10 pretty much pays for itself after we eat out one time. You should check with your local community to see if they offer anything like it. It’s a great way to support your local businesses while saving money at the same time.

Are You Following the Dave Ramsey Plan?

There are tons of great ways to save money. Dave Ramsey has put a plan together to make it easier to gain financial freedom. Dave Ramsey says you should make your money work for you, just like the Bible teaches us to manage our money wisely.

You can gain financial freedom in your life, you just need to put your mind to it. There are always challenges with budgeting so don’t let that get you off track. Make a commitment and choose to be debt-free today so you can gain financial freedom.

What is your favorite money-saving tip from the Dave Ramsey Plan?

I love this. Thank you! Recently, I just had read that I am a slave to whomever I owe a debt to and decided that I do not want to be a slave to debt once they are all paid off meaning I’m putting my college off till I can pay monthly for the semesters without loans. I can find scholarships but I cannot always count on them and so I chose to do an online semester at a new online option for a Bible school I went to years ago and be refreshed I. My Bible foundation of living for God. All my former teachers but two are now gone with new teachers taking their place but still I love the school. And with the special going on for special anniversary and new option, I can save and have support I need in my new season of my renewing my fire for God and His Word in my life. And really understanding scripture and It speaking to me by Holy Spirit and praying again and a bigger love for God and imitating Him. This post just confirmed my scripture reading for being a slave to debt and also how to get out of it it a God way. So thank you again for sharing this.

Thank you! I’m realizing I am doing some of this already. We too are paying off high interest first. I haven’t starting saving for college yet. I’m praying my son gets a scholarship athletic or academic as I did. The tip on sick leave time is golden I have $7000 worth of time in my bank. I really like you site.

I have done pretty good learning on my own. Our cars are paid have retirement money invested and paid off mortgage with a personal loan lowest interest to date. I learned the envelope method from my dad I hated it but then when married decided to save one paycheck and live off the other. Would love to hear what else you can offer