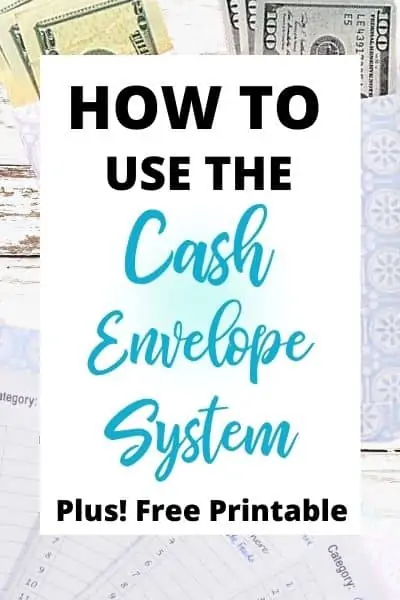

How to Use Cash Envelopes Plus! Free Printable

This article may contain affiliate links. I may earn money from the companies mentioned in this post with no additional cost to you. Please read my disclosure policy for more info. All Bible quotations are from the New King James Version (NKJV) unless otherwise stated Bible Copyright Attribution.

Making the decision to start a budget is hard. Living off credit cards is pretty comfortable until you have to pay them. Eventually, they catch up with you, and you are overwhelmed with credit card debt.

As you know, my husband and I were in the credit card debt cycle. It was a rough road when we had to settle that debt (you can read more about our debt journey on my about page).

Thankfully, God gave us the wisdom to get it paid off but we still had to suffer the consequences. The consequences were painful so we knew that we had to get a budget in place to stay debt-free.

All that to say…you need a budget. Don’t make the same mistakes we did. My goal is to help you get your budget in place and find the best budgeting method for you.

Since there are different budget methods, this post is going to specifically focus on the cash envelope system.

What is the Cash Envelope System?

The cash envelope system is a way to track your budget with cash. Each envelope will have a budget category and the amount of cash you specify for that category.

Over the month, you will track your spending on the specific envelope you spend from. At the end of the month, you can see how much money you have left in your envelope.

The envelope budget system keeps you accountable for the actual cash you have. This will help keep you from overspending and getting into debt.

Do Cash Envelopes Work?

Cash envelopes keep you limited to the money in your envelope. Once it’s gone, you can’t spend anymore. Have you ever noticed that you spend more when you don’t have physical cash?

Cards are easy to overspend with. With this method, you see the actual money when you spend it. The cash makes you much more intentional about what you’re spending.

This money envelope method only works if you commit to it. It defeats the purpose if you pull out a card when you run out of cash. If you stick to the cash method, you will not overspend.

Grab your Free Printable Budget Planner!

How to Start Using Cash Envelopes

Now that you understand more about the envelope budget system, I’m going to show you how to use it.

Here’s what I will cover:

- Steps to using the cash envelope system

- Cash envelope categories

- Free printable cash envelopes

Please keep in mind that changing your money habits can be overwhelming at first. Making changes or starting new habits can take time. Don’t get frustrated and give up. Keep your eyes on the goal of managing your money properly. The reward is well worth it.

In order to successfully use the cash budgeting system, you need to make sure you completed the following two things.

1. Make a Budget

If you don’t know where your money is going, then you can’t successfully manage it. If you haven’t done this yet, then you should follow my step-by-step guide to making a budget.

Once you get your budget in place, you can move on and track your spending.

2. Track Your Spending

Tracking your spending allows you to see how much you spend in each part of your budget. If you haven’t done this yet, take the time to track your spending for one month.

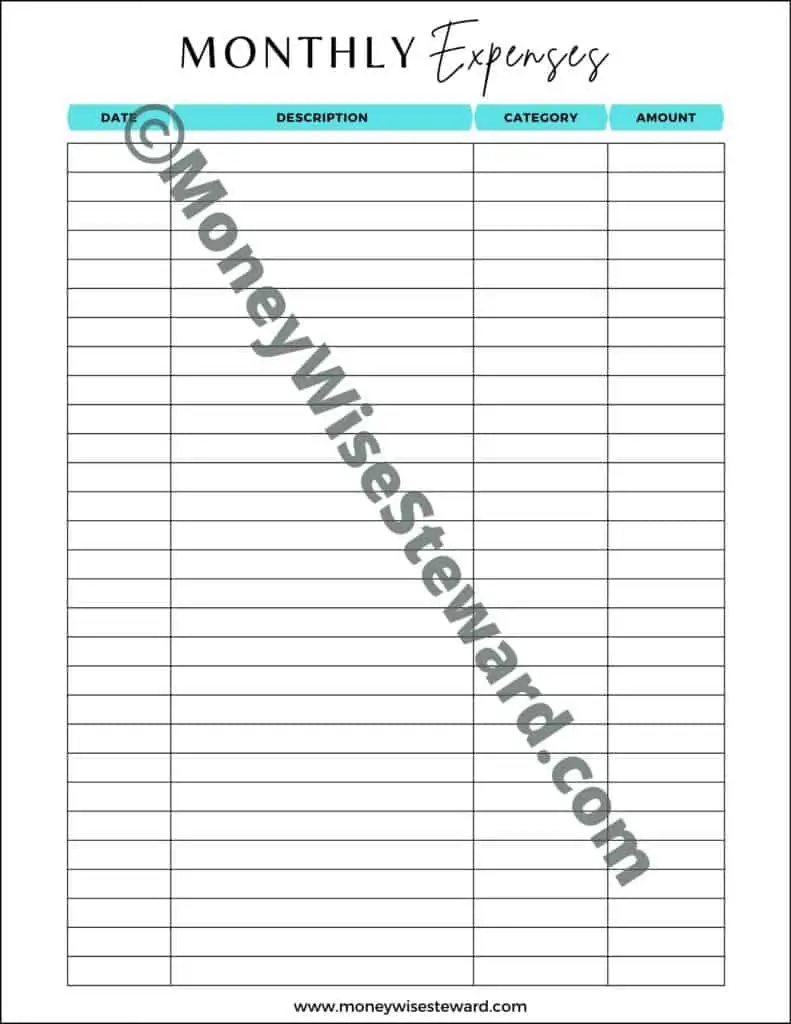

Download this free expense tracker printable and write down everything you spend. At the end of the month, add up how much you spent in each category. This will give you an idea of how much money you should allocate to put in each envelope.

The Cash Envelope System

Now that you have your category amounts established, you can set up your cash envelope categories. The cash envelopes are intended for variable expenses. Let me break this down for you.

What are Fixed Expenses vs Variable Expenses?

Fixed expenses are the expenses that are already set each month. Here are some fixed expense examples:

- Mortgage/Rent

- Car Payment

- Car Insurance

- Life Insurance

- Retirement Contributions

Variable expenses are expenses that change every month. Here are some variable expenses examples:

- Groceries

- Restaurant Meals

- Gas

- Birthday Gifts

- Shopping for Clothes

3. Figure out Your Variable Expense Categories

Once you figure out your categories, you need to set money limits for each one.

My categories are pretty cut and dry. My “Groceries” expense includes anything we get from the grocery store or convenience store. My “Restaurant Meals” expense includes any eating out of the house.

You should have a pretty good idea of what your spending is like. Make it more simple. Don’t complicate it.

Cash Envelope Categories

Here are some category ideas for your cash envelopes. Here is a list of budget categories for any type of budget system.

- Groceries

- Restaurant Meals

- Pet Food

- Clothing

- Gifts

- Gas

- Vacations

- Salon services

- Beauty products

- Entertainment

- Parties

- Misc

4. Decide what Envelopes You Will Use

Once you have your budget figured out, your cash envelope categories determined and your category dollar limits set, you need to decide what envelopes you will use.

The easiest and cheapest way is to use plain white envelopes and write on them. If you want cash envelopes that are sturdy and colorful, check out the options I’ve listed below.

Free Printable Cash Envelopes

If you want to add some style to your budget, you can use decorated cash envelopes. Sometimes cuteness just makes a budget better.

Here are my favorite free printable cash envelopes:

If you like a simple design, you can download these free cash envelopes from Maple Planners. Just head over to their site and download your copy.

If you want to purchase some instead, you can get them for a small fee. Here are some of my favorites.

I will share more money envelope ideas (cash envelope wallets) at the bottom of this post. Scroll down to check them out.

5. Label your Cash Envelopes

When you have your envelopes ready, you need to start labeling them with your categories. Write one category name on each envelope.

Then write the budget amount you’ve decided on that envelope.

6. Decide When you will Pull Out Cash

This step depends on when you receive your paychecks. If you budget paycheck to paycheck, then you will pull out cash each time you get paid.

If your budget covers the month, then you would pull the cash out so it lasts you the whole month.

7. Pay Your Fixed Bills

As I mentioned above, your fixed bills are not part of your envelope budget system. You can either pay these by mail or online.

It’s easier for me to have them automatically debited since I have to pay them anyway. It’s up to you how you want to pay your fixed expenses.

8. Stuff your Envelopes with Cash

Add up the total cash you have budgeted for your envelopes and withdraw it from the bank. Now that you have your cash pulled out, you need to stuff it in your designated envelope.

If you budgeted $200 for “restaurant meals”, then you would put $200 cash in your “restaurant meals” envelope. Continue doing this until all your cash envelopes are filled.

9. Use only the Cash You Specified for the Category

Since you have determined the dollar amount for each category, you should only be spending the cash in that specific category.

If you start borrowing from other categories, you may run out of money in the category you are borrowing from.

This will take trial and error. Sticking to the cash you have in the envelope will make your budget envelopes most effective.

10. Don’t Give Up

Budgeting money is not easy. You have to be intentional about it. The easiest thing to do is give up. Don’t do it. You will experience so much freedom when you stop letting your money manage you.

Budget challenges will come but you need to push through them. There are several ways to help your budget. You can choose to live a more simple lifestyle or you can become more frugal with your spending.

I learned to use coupons and it has saved me a ton of money. There are multiple ways to make your budget comfortable. You just need to decide to do them.

Should I Use Cash Envelopes?

Now that you’ve seen step-by-step on how to use the cash envelope system, you should be able to make a decision if it will work for you.

I have found that carrying around money envelopes is difficult. It works for some people but not everyone. I’ve been serious about budgeting over the last 10 years and I’ve tried several different ways to budget.

The budgeting system that works best for me is an online system. I basically break down my categories and use an online budget app to track my spending.

The app is right on my phone so once I spend money, I add it to a specific category. It works great for us.

My hope is that this post has helped you understand the cash budget method. It’s a great system if you don’t mind carrying around cash.

Cash Envelope Wallets

As promised, I’m sharing my favorite cash envelope wallets with you. These wallets allow you to separate your cash envelopes but instead of the envelopes being loose they stay organized in a wallet. Such a genius idea!

- Value package - The Envelope Budgeting System includes 1 stylish wallet with 12 envelopes, 12 budget sheets, 1 binder note for organizing - perfectly help you make budgeting and managing finances easy & fun.

- Simple yet elegant - Our wallet is made of quality PU leather with a smooth zipper closure and offers plenty of room to store your cards, coins, envelopes, coupons and more.

- Unique and durable - Laminate coating budget envelopes are sturdy and come in 12 easy-to-identify patterns with blank pages to mark categories. Each measures 6.6" x 3.5" with a secure closure and is hole pouched to fit in the binder and be carried with wallet.

- Keep Track - The budget tracker sheets enable you to record the amount of cash in and out for each category - helps you monitor and control your spending effectively. Printable template is included!

- 100% SATISFACTION - We will refund your money if you aren't happy with your cash envelopes wallet.