4 Important Money Management Tips For Financial Success

This article may contain affiliate links. I may earn money from the companies mentioned in this post with no additional cost to you. Please read my disclosure policy for more info. All Bible quotations are from the New King James Version (NKJV) unless otherwise stated Bible Copyright Attribution.

Did you know that 50% of Americans don’t know how to manage money? They don’t know where their money is going every month.

I confess I used to be one of those people. I used to spend money and if I ran out of “real money”, it would go on my credit card.

Well, that added up and I ended up having $35,000 of credit card debt. Yep! You read that right. I was a slave to my credit cards.

This is a real example of what happens when you don’t manage your money. It manages you! There are a few reasons this can happen.

1. People don’t know how to manage money.

Managing money is not something that comes easily. It is something you need to learn.

It doesn’t have to be complicated. There are plenty of money managing tips that can help you get on the right track.

2. People don’t want to manage money.

Some people have a lot of money so they don’t pay attention to where it goes. They bank on the idea that they’ll always have money and don’t realize that they can lose that source of income at any time. Or they simply don’t want to take the time to manage money.

I can honestly say that I fell under the “People don’t know how to manage money” category. I grew up in a household where my parents supplied everything I needed and wanted. There was never a shortage of money.

When I started working and paying my own way, I had to figure out how to manage money on my own. Like, I mentioned above, I learned the hard way. Credit card debt!!!

Who Says We Need to Manage Money?

The Bible says God is the provider of everything we need. One thing God provides for us is money. We need it to survive in this world and God knows that.

The catch here is that God has entrusted money to us to be used properly. We are accountable to God for the way we use everything He provides for us. This includes money.

Learning how to manage money is important if we are walking with Christ because we are called to be good stewards of this resource (Matthew 25:14–27). It keeps us from being a slave to money and gives us financial freedom.

God created us and He tells us that we cannot serve both God and money (Matthew 6:24). This doesn’t mean having money is a bad thing. It’s the “love of money” that causes the problem.

If we allow money to take God’s place then we are in big trouble. Unfortunately, this can happen if you don’t manage your money. If we allow all our financial desires to take over us then we can easily turn that into an idol. Read more in-depth: What the Bible Says About Money?

How To Manage Money

Being a good steward of money is a big part of my life. The Lord has blessed us with enough money that I can stay home and homeschool my children. This is a huge praise and blessing considering the debt that I was in (If you want to know about that read my about me page to see how God worked that out).

Having control of the money the Lord gives us each month is very important to me. My husband trusts me to manage our finances every month. I know that I will be answering to the Lord for everything that I do and I want to do it right.

If you made it this far then I’m going to assume you want to learn how to manage money. Maybe you are just starting out or maybe you want to get back to managing your money. It can be easy to get off track but the good news is you can get back on track fairly quickly.

I’m going to share some money managing tips that will get you on the right path.

Money Management Tip #1

Make a commitment to learning how to manage money. This is such a big deal! The hardest part is sticking to your commitment. I recommend that you get a journal and write down your commitment and goals. Make sure to pray about it. The Lord will give you wisdom and strength to get there.

You may be doing this to get out of debt, to save money, or just to control your money. If you are married, talk to your spouse and get them on board. You’ll need to work together so you can reach your goals.

Money Management Tip #2

Set your goals. If you are paying off debt then you should work on setting a goal to pay it off. Calculate your debt and figure out how much you can pay off each month to get it paid down.

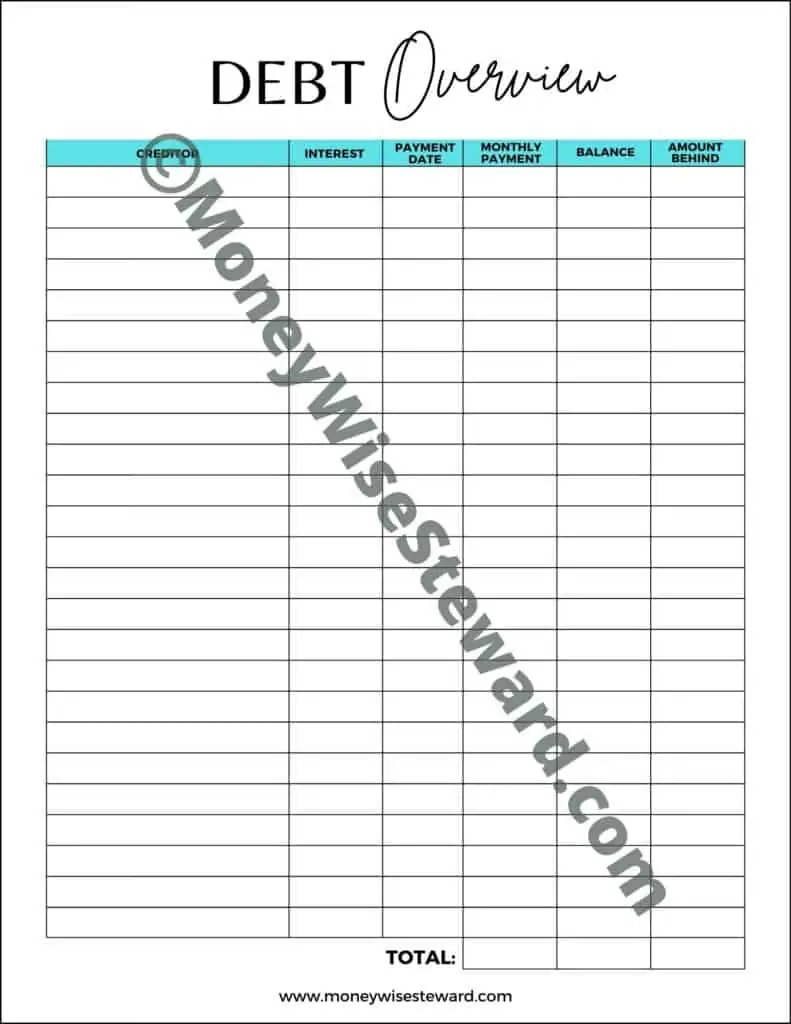

STEP #1 – FIGURE OUT HOW MUCH DEBT YOUR HAVE

I know this is hard to swallow but it’s important to know how much you owe upfront so you can get rid of it.

I recommend that you get a notebook or binder dedicated just to your finances. It’s important to keep all your financial goals in one place. The best part is that when you reach your financial goals, you can look back at your accomplishments.

Now, get your notebook/binder, sit down, and write down every single debt that you have. Include money that you owe to credit cards, medical bills, household bills, even late fees, and money you may owe to friends and family. Having a picture of everything will give you a great start so you don’t have any surprises.

Make the following columns for each debt or print this free debt printable pdf I created.

Examples of Debt:

- Creditor (who the debt is owed to)

- Balance (the total amount of the debt)

- Interest Rate

- The monthly payment

- The payment date

- If you are behind on any amount.

Now calculate your total amount of debt.

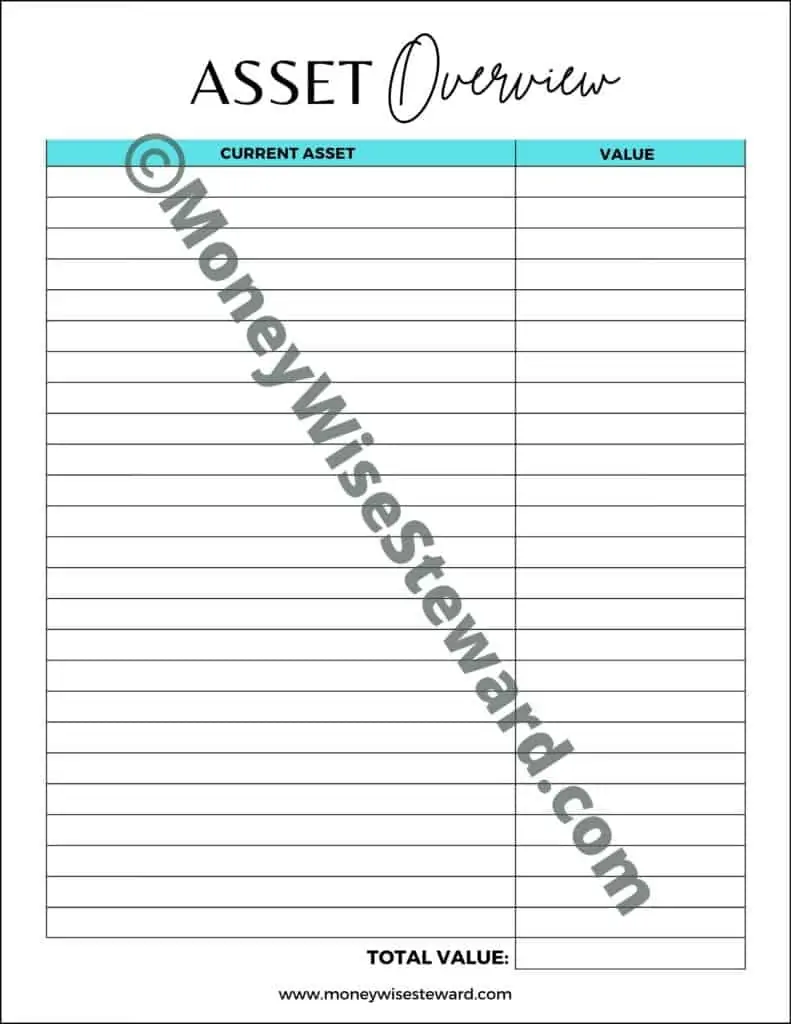

STEP #2 – WRITE DOWN YOUR ASSETS

An asset is something you have that you could sell to get money.

If you own a house and owe less than it’s worth, you could potentially sell it to get money. Example: If your house is worth $250,000 but you only owe $100,000, then you could sell it to get $150,000 (of course, there will be fees involved in selling a house but I’m trying to give you an easy illustration).

Write your assets in your notebook/binder or print this free asset printable pdf I created.

Examples of Assets:

- Car

- Retirement

- House (market value)

- Furnishings (Choose an average for all unless you have something of high value. I average my furnishings to around $2500)

- Savings account

- Off-road vehicles, boats, etc.

Make sure you don’t include the cash you use that’s not extra.

Now calculate your total amount of assets.

STEP 3 – CALCULATE YOUR NET WORTH

Now that you have your debt and asset totals, you can figure out your net worth. This is easy to figure out. Take the total amount of your assets and subtract your debt. This is your net worth.

Here’s an example:

Assets:

- $360k (market value)

- $10,000 car

- $8,000 car

- $2,500 furnishings

- $5,000 boat

- $25,000 retirement

Total assets: $410,500

Debts:

- $320k mortgage

- $5,000 credit card #1

- $10,000 credit card #2

- $50,000 student loan

- $30,000 car loan

- $15,000 car loan

- $25,000 boat loan

Total debt: $455,000

Here is the total net worth based on the above figures $410,500 – $455,000 = -$44,500. This means that based on the numbers above there is $44,500 more debt than assets.

What is your net worth?

Make sure to write this down in your notebook or binder and document the date. It’s important to add dates. It helps you keep track and see your accomplishments.

The goal here is to get your debt paid down and increase your net worth.

Money Management Tip #3

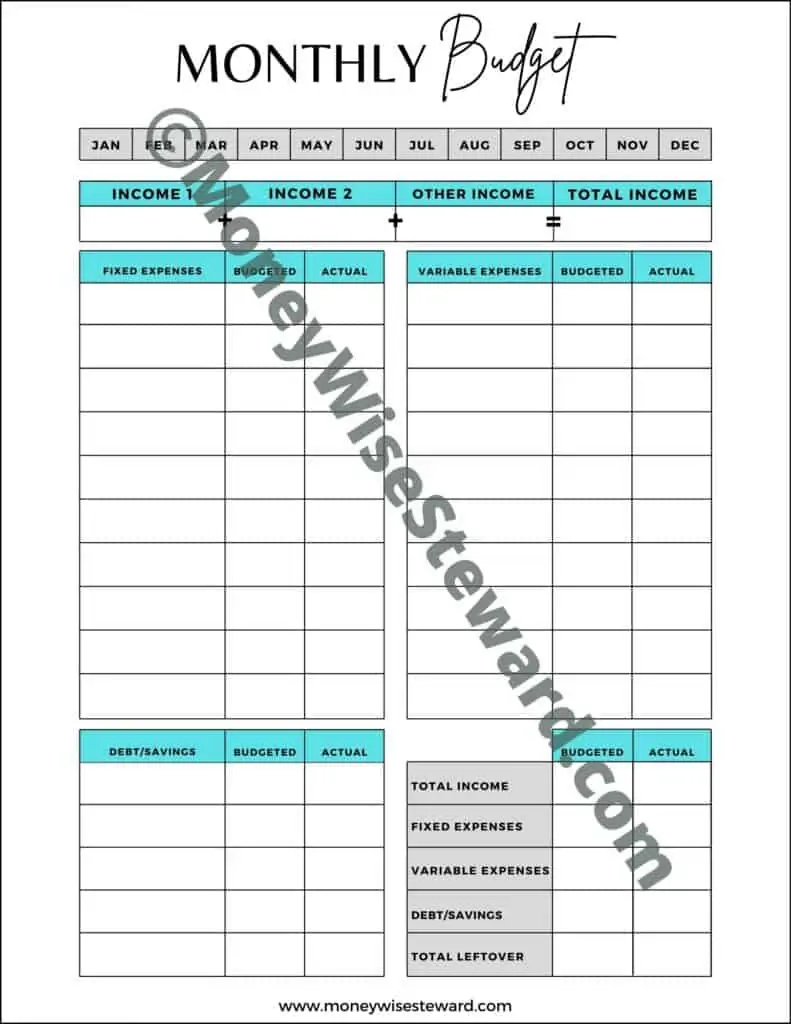

Create a budget. No matter how much money you make, you need a budget! Read this in-depth post about how to create a budget. Our monthly budget is my guide. If I didn’t have my budget in place then I would be right back in credit card debt.

Knowing the exact amount of money you have each month is the key to managing your money. You tell it where to go. Make it work for you. Print this free monthly budget form or if you prefer to track your budget electronically, you can use a free online budget template.

Money Management Tip #4

Learn how to save money. When I ditched the credit cards, I had a really good idea of how much money we actually had. It made me a little sad to see how little we had. This motivated me to learn how to save money.

When I say “save money“, I’m not talking about being cheap. It is possible to get nice things for the fraction of the price you are used to paying. Learning to live on one income with a family of 5 started out as a challenge. Thankfully, I made a commitment to learning how to save money so I could make our money stretch further.

I’ve compiled a list of the best ways to save money to give you a good start.

What’s Next with Managing Your Money?

Now that you have a budget in place, you need to focus on getting your debt paid off. Make sure that you’ve created a category for it in your monthly budget.

- Stick to your budget and adjust it as life changes and your debts are paid off.

- Put time into learning how to save money. I’ve written several articles on saving money and I will continue to add more ways to save as I find them.

You may have a long road ahead but I’m praying that you will see the importance of managing your money.

We were on that long road of learning how to manage our money but we got to the end of that road and are on the other side of it now. Stay encouraged and know that the reward is well worth it!

I’m very much interested to receive your newsletter.

Thank you for taking the time and care in helping others. I am now a single mom, not budgeting very well, but ready to buckle down my spending and let the Lord lead the way. Thank you for your inspiration.